Carin Johansson giving an excellent overview of the state of number portability worldwide

I had the privilege of attending the IQPC Number Portability Global Summit earlier this month.

Number portability has been important for the development of competition in telecoms. The conference addressed a wide variety of topics around the subject. Here are some of the points that resonated:

- According to one well-respected speaker, 75 countries have implemented number portability (NP) on their fixed (FNP) or mobile (MNP) networks.

- Many others, including Jamaica, Trinidad, Afghanistan, Armenia, Togo and Tunisia are likely to implement number portability by the end of 2014.

- Some countries, e.g. Russia, are struggling against technical, commercial and political obstacles to implementing number portability

- User experiences of MNP vary widely. In Portugal, callers to ported numbers are greeted with a message warning them that the call may cost more. In countries like Ireland, Ghana and Israel, mobile numbers can be ported in under an hour, whereas in some other countries it can take weeks.

- In some countries (e.g. UK) the customer approaches her current network and requests porting (this is known as donor-led porting). Best practice, followed by many countries, is that the customer requests porting from the network to which they wish to port (recipient-led porting).

- The technical platforms and processes underpinning porting continue to evolve, in response to customer needs (or rather operators’ new product opportunities), technical advances and the pursuit of efficiencies.

My talk to the conference covered three areas:

1. The evolution of in the importance of number porting

Mobile numbers will continue to be an important way to be reached by almost all mobile users, but callers can now find and contact at least some of their targets on social media.

The evolution of the importance of number portability

Against that, the cost and difficulty of porting is now very low in most markets, so porting will continue to be popular for the foreseeable future.When truly portable mobile phones arrived (first for businesses, then with the advent of prepaid, for the mass market), the mobile phone number filled a need left unfulfilled: a simple reliable means of reaching someone anywhere, anytime. Porting was introduced to improve the free functioning of telecoms markets. In 2003, the value of porting to the Irish economy was estimated at £IR 129M.

More recently, social media has emerged as a far superior way to find and contact people. Although it has limitations, it removes many of the costs of changing the mobile number. However, in parallel the costs (monetary and service interruption) to users of porting continue to decline, and many operators incentivise port-in. Number porting is here to stay.

2. Insights based on analysing porter data

Idiro has analysed data relating to porting customers in a variety of markets. I presented a number of insights (anonymised, of course) on the characteristics of porters based on multiple markets. I also described in detail the phenomenon of porting contagion. The power of word-of-mouth results in many consumers following their friends when they switch networks. This accounts for a high proportion of porting overall. Big thanks to my Idiro colleague Lorcan Treanor for the analysis behind these insights. Please contact Idiro to learn more about these insights.

3. How Idiro SNA helps meet the challenges of porting churn

The SNA analytics service from my employers, Idiro, is a perfect fit for the marketing problems around mobile number porting. Idiro scores can be used in Member-get-member acquisition campaigns and in retention campaigns to reduce porting churn.

Freddie McBride of CEPT presenting on service portability

I was chairman on the second day of the conference, which focussed on Service Portability. There is great interest in this topic – where the customer ports not only their fixed and mobile numbers but other elements of their package as well, up to the entire quad-play bundle.

Though the concept is an appealing one, in practice the challenges are large. Imagine being a customer with a home phone, mobile phone, TV and broadband bundle, and moving it to a competitor. Every provider’s service bundle is different, and porting the entire bundle will require the customer (or the recipient operator) to make careful choices. In addition, speakers pointed out that the delay in porting different services will vary, so during a transition period the customer will be receiving some services from the donor operator and some from the recipient operator.

There are challenges aplenty there and it is clear that there is no consensus over the best way forward. One might (at the risk of overestimating the similarities) say that the discussion on service portability is where the number portability was 25 years ago.

Overall, the conference was well-organised and the speakers well chosen. However, as with many other telecoms conferences, the voice of the customer was hardly heard at all. Quality was mostly described in technical telecoms terms, rather than the quality as measured by the user. Almost no primary or secondary research on customer experience was presented by regulators, operators or vendors. At the end of the conference (I missed one talk) I had learned nothing about consumers’ expectations for porting and how well they were being met.

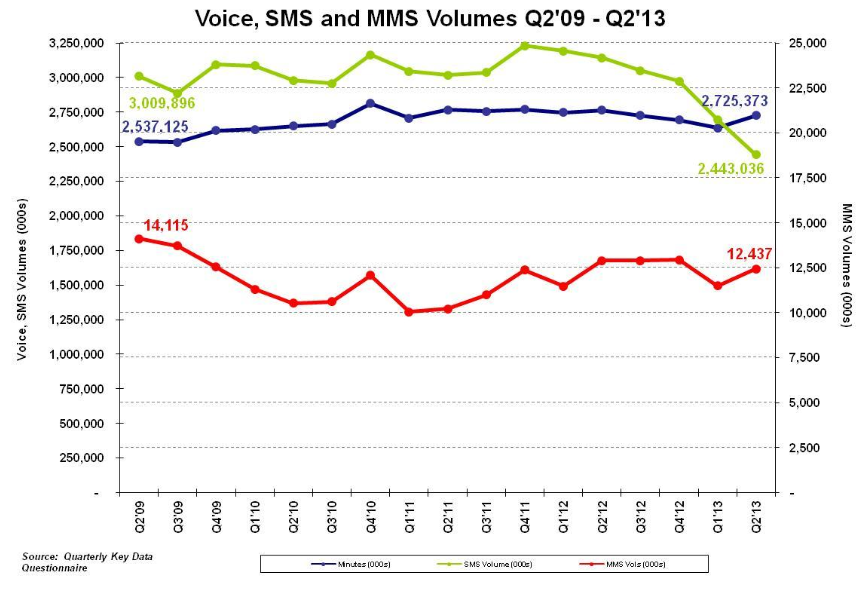

If the voice of the consumer is not heard, how will their needs be met? It was ever thus in the telecoms industry – or at least, it has been for the last 25 years – and it is a reason that OTT services like Whatsapp are eating SMS and MMS’s lunch. Despite being excellent in what it did cover, by its omissions this conference reminded me again of why the telecoms industry needs to cop itself on and develop a passion for the customer, or risk its share of customer communications being progressively eroded.

(a version of this post appeared on the Idiro blog)

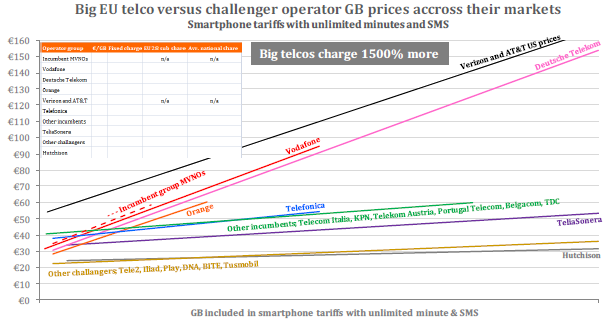

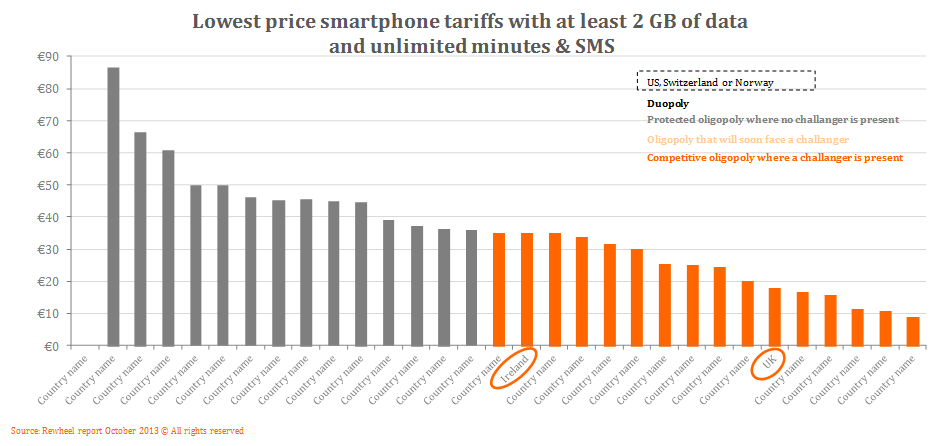

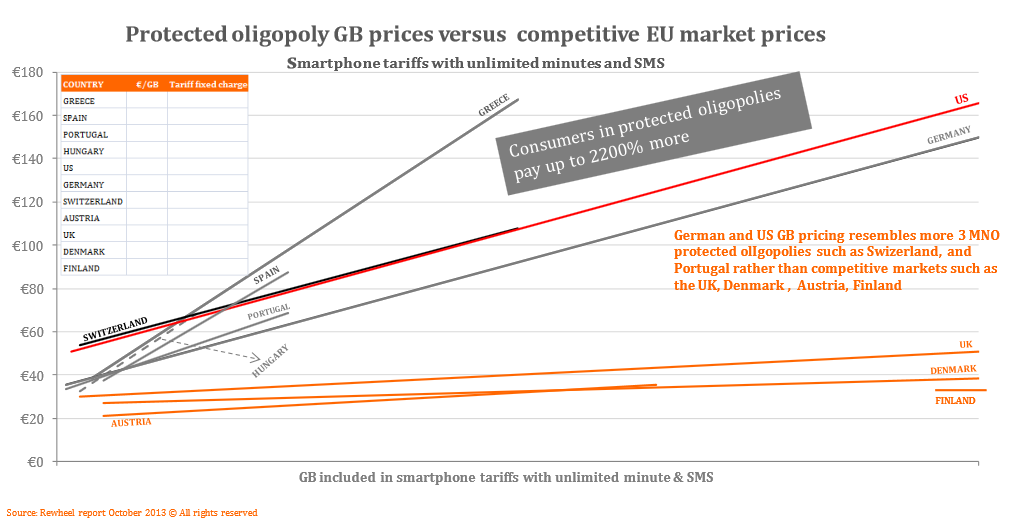

The report describes mobile internet (at the risk of hyperbole) as ‘the fuel of digital economies’ and finds that pricing for these bundles in Europe’s ‘protected oligopolies’ (e.g. Germany, Spain, Greece and Hungary) is up to 2200% higher than the the EU’s most competitive markets (UK, Sweden, Finland, Denmark & Austria). It also finds that big EU telcos tend to charge more. No surprise: there is no point investing millions in a multinational brand if you can’t leverage it by charging a premium for services.

The report describes mobile internet (at the risk of hyperbole) as ‘the fuel of digital economies’ and finds that pricing for these bundles in Europe’s ‘protected oligopolies’ (e.g. Germany, Spain, Greece and Hungary) is up to 2200% higher than the the EU’s most competitive markets (UK, Sweden, Finland, Denmark & Austria). It also finds that big EU telcos tend to charge more. No surprise: there is no point investing millions in a multinational brand if you can’t leverage it by charging a premium for services.