Earlier this year the media carried a couple of stories about 5G in Ireland, breathlessly giving us news of Irish telcos’ activities around this exciting new technology.

So what is this 5G thing? It’s the fifth generation of mobile communications technology, of course.

- 2G (GSM) moved us from from the old analogue TACS (088) networks, giving us international roaming and SMS messaging, and the beginnings of mobile data on the phone.

- 3G (UMTS) brought a big improvement in mobile data speeds, creating the opportunity for the iPhone and its followers.

- 4G (LTE) is bringing us further improvements in bandwidth, or speed, and cleans up some of the complexity that 3G introduced.

And 5G? No need to tell you that it will bring an increase in mobile data speeds – every generation of network innovation has to bring that. It also reduces the latency, which is what we call the time taken for a piece of data (say, a request to open a web page) to travel from your phone to the network.

In Ireland, 5G will use the 3.6GHz band. 5 organisations were successful in last year’s spectrum auction – Imagine Communications, Airspan Spectrum Holdings (a new player in Ireland), Vodafone, Three and Meteor/Eir. This spectrum is not tied to a particular technology – in fact, Imagine is already providing fixed wireless broadband services in this band.

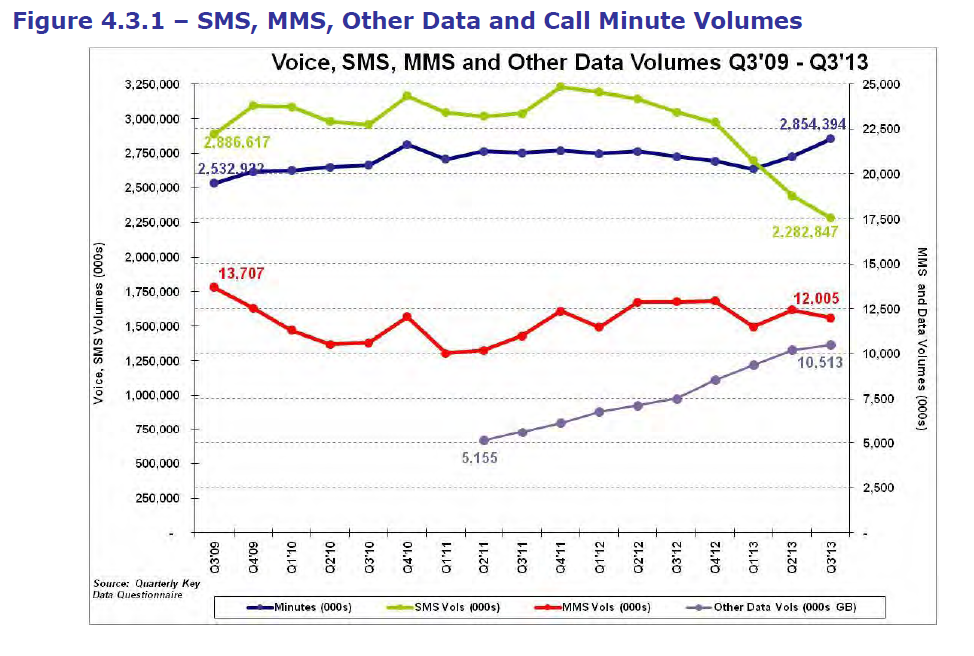

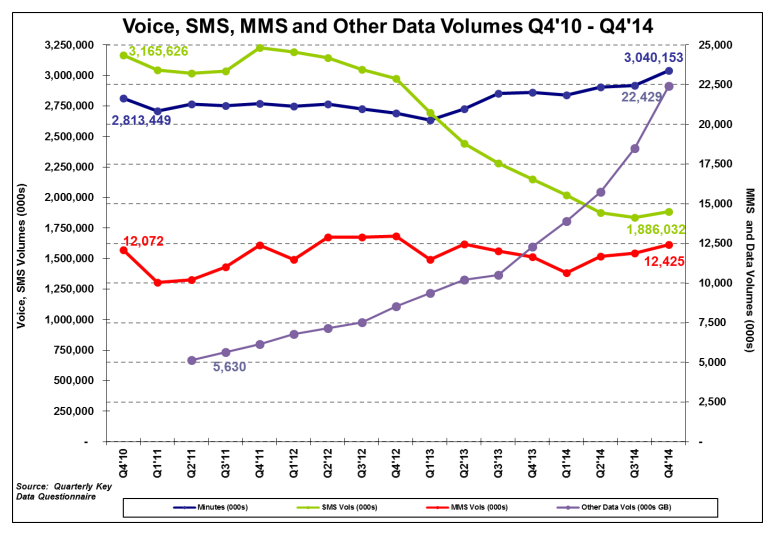

So why did the powers that be decide that we need 5G? Two reasons. Firstly, as smartphones get smarter, we humans are sending and receiving more and more data.

Secondly, more and more of the things that people and businesses own (cars, public rubbish bins, microwave ovens, cows, alarm systems, vending machines, pacemakers, bus stops…) are being connected to the internet. This is what we call the ‘Internet of Things’ or IoT. The applications and benefits of these connections vary widely, but what they all have in common is that they need to send and receive data. The idea is that 5G will bring the faster speeds, greater capacity and (Importantly) the lower latency that some new IoT applications require, and the extra capacity that the growth in IoT traffic requires.

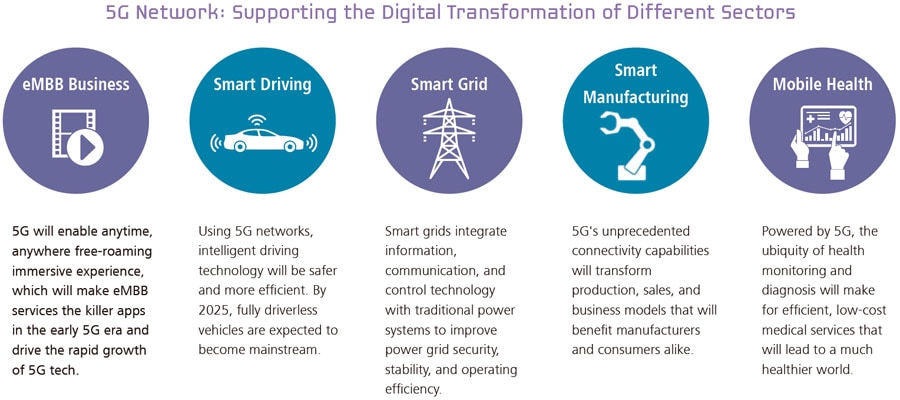

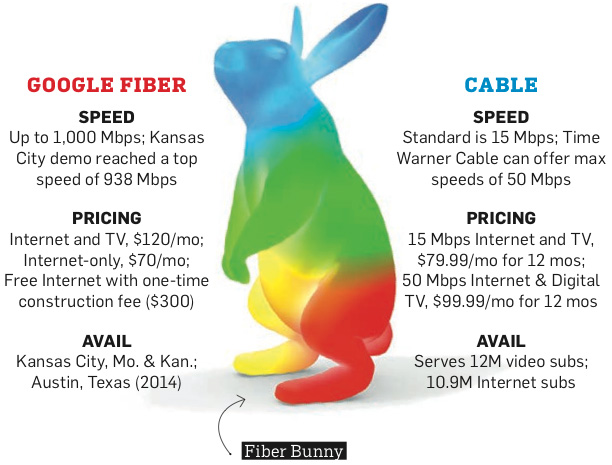

Each new generation of mobile technology represents an opportunity for telecom vendors to gain market share. Huawei’s making plenty of effort on 5G – here is their take on the key 5G applications (source). eMBB is enhanced mobile broadband, by the way.

Huawei’s view of the key 5G applications

However, experts can’t agree on what applications will drive 5G. To this author, the discussion around 5G applications feels a bit like that around WAP (the first mobile standard for web browsing) – long on hype and short on solid use cases based on implementable solutions. One mobile industry CTO suggested to me that the most likely initial application for 5G is fixed wireless broadband. This may mean rural areas being prioritised for initial coverage, rather than the exclusive focus on cities that some commentators predict.

In practice, 5G won’t have an impact until 2020 at the earliest, and as we all know, in mobile telecoms as lot can change in 2 years. It will be very expensive to deploy. One reason that it will take so long and cost so much is that 5G is an entirely new network, built, more or less from the ground up. Another reason is that 3.6GHz is a higher radio frequency than 2G/3G/4G use. Because signals at the higher radio frequencies don’t travel as far, more base stations are needed. The huge costs of deploying 5G networks may lead to an increase in network sharing or industry consolidation. Watch this space.

is An Post’s chain of retail outlets. It focuses on customers with relatively simple mobile needs looking for low-cost mobile service from a trusted brand. It uses Vodafone’s mobile network.

is An Post’s chain of retail outlets. It focuses on customers with relatively simple mobile needs looking for low-cost mobile service from a trusted brand. It uses Vodafone’s mobile network.